Wondering How to Check Capital One Credit Card Application Status? It’s quite simple and straightforward. Like other people, you also wanted to check your credit card application status after applying at getmyoffer.capitalone.com. You can verify the status of your credit card application by either logging into their online portal or directly contacting customer service for an update.

This quick guide will walk you through the steps required, making this process less complex and more approachable. So whether you’re a tech-savvy individual or someone who prefers traditional methods, we’ve got all bases covered!

If you haven't selected and applied for a credit card yet, then you should take a look at some of the best credit cards offered by Capital One and then apply via the official website.

Table of Content

- 1 How to Check Capital One Credit Card Application Status?

- 2 Check Capital One Credit Card Application Status (Step-by-step)

- 3 Waiting Period and Typical Timeframes

- 4 What to Do if Your Capital One Credit Card Application is Denied?

- 5 FAQs

- 5.1 What is the Capital One credit card application process?

- 5.2 How can I check the status of my Capital One credit card application?

- 5.3 How long does it take to receive a decision on my Capital One credit card application?

- 5.4 What factors influence the approval of a Capital One credit card application?

- 5.5 What should I do if my Capital One credit card application is denied?

- 5.6 Can I check the status of my Capital One credit card application multiple times?

How to Check Capital One Credit Card Application Status?

Checking the status of your Capital One credit card application is easy and can be done in a few different ways:

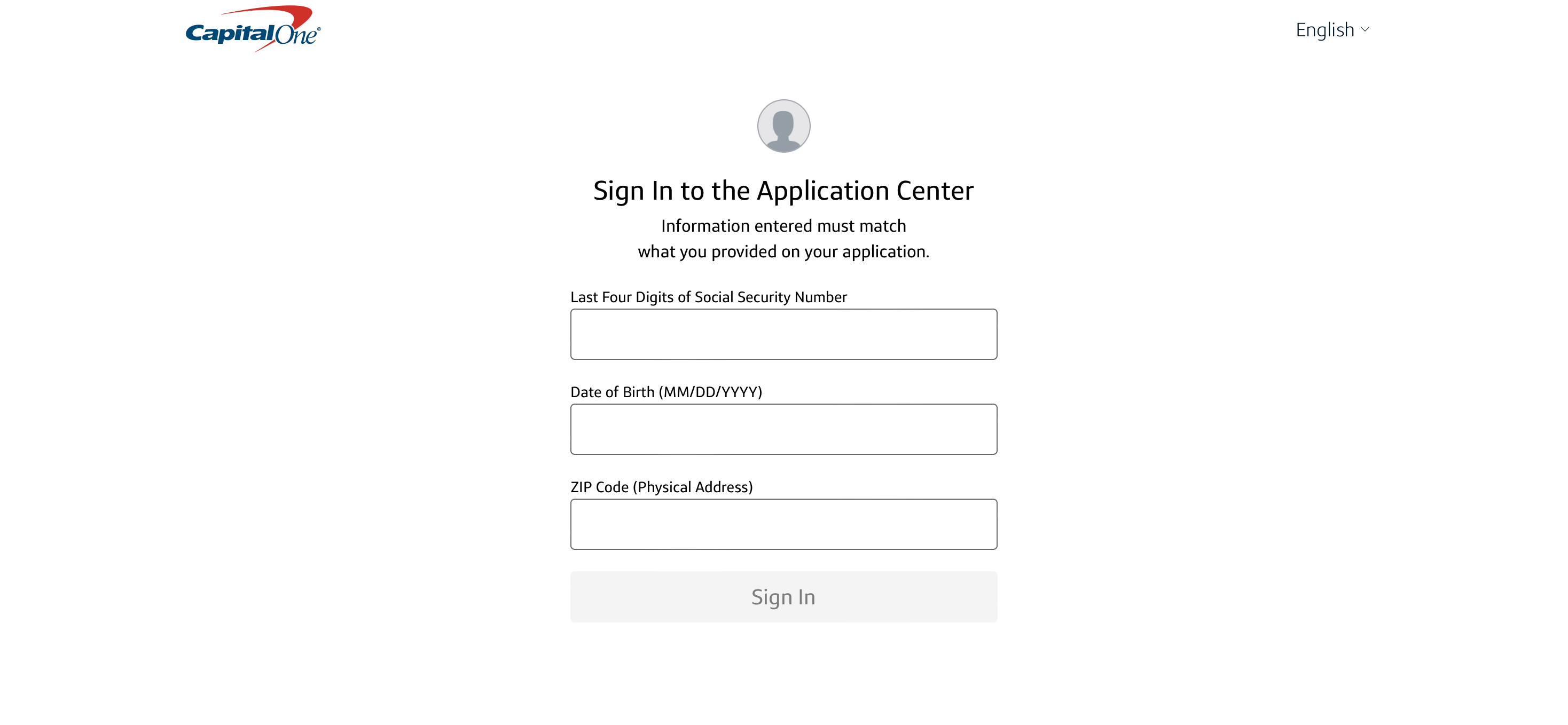

- Online: To check the status of your credit card application online at the application center, you will require the following details: the last four digits of your Social Security number, your date of birth, and your ZIP code.

- Telephone: Call the automated hotline at 1-800-903-9177, available 24/7.

Remember, have your Social Security Number (SSN) handy as you'll need it whatever method you choose.

Check Capital One Credit Card Application Status (Step-by-step)

Online Method

To check your application status online, follow these steps:

- Visit the Capital One Application Center.

- Fill out the form below with the information listed below.

- Last 4 Digits of the social security number

- Date of Birth

- ZIP Code

- Verify all the entered information.

- Click on the “Sign In” button.

- Verify your login with OTP.

Here you can see the current status of your credit card application.

Phone Method

If you prefer a more personal touch or do not have access to the internet, you can choose this second method. In this method, you need to call the Capital One Customer Service Number and ask for their assistance to know the current status of the Capital One Credit Card Application.

- Capital One Customer Service: 1-800-903-9177

Call this number and provide them with necessary information such as SSN or zip code when prompted.

Remember, only use this method if you are comfortable sharing sensitive information over phone.

Mobile Application

Alternatively, you can also use Capital One mobile app to check status of your Credit Card Application hassle free:

- Download and install it from Google Play Store (Android) or Apple App Store (iOS).

- Open the app and log in using your credentials.

- Tap on ‘Menu’ then find and select ‘Application Status’.

Your application status should be visible there immediately after logging into your account.

Each method is effective for different situations so choose what works best for you.

Here are some common statuses that can appear on the portal:

| Status | Description |

|---|---|

| Approved | Your application has been accepted and your card should be on its way soon. |

| Under Review | The bank needs additional time to assess your eligibility for their product. |

| More Information Needed | The bank requires more details from you before they can make a decision. |

Waiting Period and Typical Timeframes

Understanding the waiting period after submitting an application is important. Several factors can affect the processing time, including the type of credit card and the volume of applications received. Here are the average processing timeframes for different types of Capital One credit cards:

- Standard credit card applications: Typically, the average processing time for these applications ranges from 7 to 10 business days. However, it’s important to note that this time frame can vary based on various factors.

- Premium credit cards or specialized programs: These applications may require additional processing time due to their complexity. It may take up to 14 business days to receive a decision for such applications.

What to Do if Your Capital One Credit Card Application is Denied?

Don’t panic if your application for a Capital One credit card gets denied. There are several steps you can take:

- Request an explanation: Capital One must provide a reason for denying your application, usually by mail or email. This information can help you understand what issues need to be addressed.

- Check your credit report: You’re entitled to a free credit report from each of the three major bureaus (Experian, Equifax and TransUnion) every 12 months through AnnualCreditReport.com. Review these reports for any errors that could have affected your application.

- Improve your credit score: Work on improving aspects of your financial health like paying bills on time, reducing debt levels, and avoiding new debts.

- Apply for a different type of card: If you’ve been denied for one particular card, it doesn’t mean all cards will be out of reach. Consider applying for a secured credit card or a card designed specifically for people rebuilding their credit.

But make sure, multiple applications within short periods may negatively affect your overall credit score and credit history due to hard inquiries on the account. So wait some time before reapplying.

FAQs

What is the Capital One credit card application process?

Submit personal and financial details to Capital One for evaluation, considering your credit history, income, and other debts.

How can I check the status of my Capital One credit card application?

Check your application status online by logging into your Capital One account and selecting “Application Status”, or call 1-800-903-9177.

How long does it take to receive a decision on my Capital One credit card application?

The decision time varies; it might be instant or take several days to weeks, depending on the complexity of the review and any additional information required.

What factors influence the approval of a Capital One credit card application?

Approval depends on factors like credit score, income, employment history, and debt-to-income ratio. Ensure to provide accurate, current details for a higher approval chance.

What should I do if my Capital One credit card application is denied?

If denied, request a decision explanation and review your credit report for improvement areas. Consider applying for a secured card or another issuer’s card with lenient criteria.

Can I check the status of my Capital One credit card application multiple times?

Yes, you can check your application status multiple times online or via phone, but frequent checks won’t hasten the process and may lead to frustration. It’s advisable to wait a few days before checking again.