Dive right into the heart of financial innovation with Capital One, a powerhouse in the banking industry that’s much more than just credit cards. This article is your one-stop guide to everything you need to know about Capital One, charting its journey from a small-time startup to becoming one of America’s leading banks.

In this digital age where technology and finance intersect, Capital One stands tall as an innovator redefining customer experience. So whether you’re curious about their services or interested in their corporate culture, we’ve got you covered!

Table of Content

- 1 History of Capital One

- 2 Financial Services Offered by Capital One

- 3 Frequently Asked Questions

- 3.1 What are the requirements to open a Capital One checking account?

- 3.2 How do I apply for a Capital One loan?

- 3.3 How do I set up online banking with Capital One?

- 3.4 How do I reset my Capital One online banking password?

- 3.5 How do I transfer money between my Capital One accounts?

- 3.6 How do I deposit a check into my Capital One account?

- 3.7 How can I get help with my Capital One account?

- 3.8 What is Capital One’s mission statement?

- 3.9 What are Capital One’s core values?

- 4 Wrapping It Up

History of Capital One

Capital One Financial Corporation, a bank holding company specializing in credit cards, auto loans, banking and savings accounts. A brief history:

- Founded by Richard Fairbank and Nigel Morris in 1988.

- It started as a spin-off of Signet Banking Corp’s credit card division.

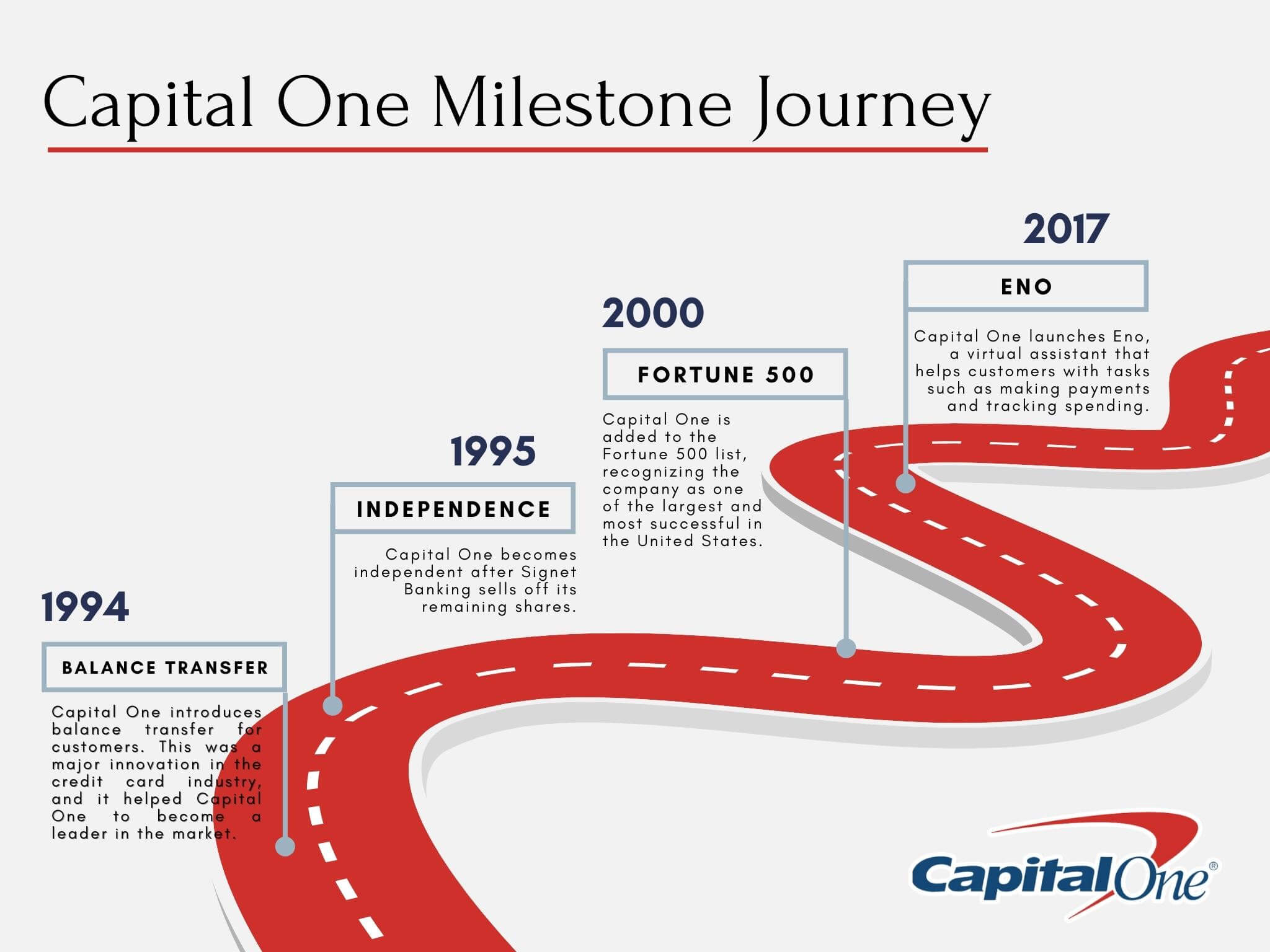

Here are some significant milestones in the company’s journey:

- 1988: Capital One is founded as Signet Bank’s credit card division.

- 1994: Capital One introduces balance transfer for customers.

- 1995: Capital One becomes independent after Signet Banking sells off its remaining shares.

- 1996: Capital One launches Auto Finance Division.

- 1998: Capital One acquires Summit Acceptance Corporation, an auto financing company.

- 2000: Capital One is added to the Fortune 500 list.

- 2001: Capital One acquires PeopleFirst, an online car loan service.

- 2005: Capital One acquires Hibernia National Bank, a regional bank based in New Orleans.

- 2006: Capital One acquires North Fork Bancorporation, a regional bank based in Long Island, New York.

- 2008: Capital One acquires Chevy Chase Bank, a regional bank based in Washington, D.C.

- 2012: Capital One launches 360 Checking, a new type of checking account that offers features such as mobile check deposit and overdraft protection.

- 2014: Capital One launches Spark Business, a new line of credit card products for small businesses.

- 2017: Capital One launches Eno, a virtual assistant that helps customers with tasks such as making payments and tracking spending.

- 2020: Capital One launches CreditWise, a free credit monitoring service.

- 2021: Capital One announces plans to acquire ING Bank USA, a subsidiary of ING Group.

This timeline highlights the significant milestones and acquisitions in the history of Capital One Bank, showcasing its growth and expansion over the years.

Capital one has been pioneering various financial services over the years to meet consumer needs across different segments.

Please note that this is just a small part of their rich history!

Financial Services Offered by Capital One

Capital One provides a wide range of financial services to cater for diverse needs. Here are the key offerings:

- Credit Cards: Various options like rewards, travel, and business credit cards.

- Banking: This includes savings accounts, checking accounts, and certificates of deposit (CDs).

- Auto Loans: Offers new car loans, used car loans, auto refinancing.

- Business Services: Provides capital solutions for businesses including lines of credit and commercial real estate loans.

Banking Products

- Checking Account: Daily banking transactions with no minimum balance required or monthly fees.

- Savings Account: Competitive interest rates with no monthly fees or minimum balance requirement.

- Certificates of Deposit (CD): Fixed-term investment that offers higher interest rate than regular savings account.

Auto Loans

- New Car Loan: For brand-new cars directly from a dealership.

- Used Car Loan: For pre-owned vehicles from a dealership.

- Auto Refinancing: Allows you to lower your current auto loan rate.

Business Solutions

- Lines Of Credit

- Commercial Real Estate Loans

- Equipment Leasing & Finance

Always remember each product comes with its own set of terms and conditions which should be carefully reviewed before signing up.

Also, if you want to know various ways to apply for a Capital One credit card, here is a detailed blog post on the same topic. As well, check out the guide to applying for a new Capital One account online!

Frequently Asked Questions

here are 10 of the most common FAQs related to Capital One that people search for on Internet:

What are the requirements to open a Capital One checking account?

You must be at least 18 years old and have a valid Social Security number. You will also need to provide a physical address and a checking account history.

How do I apply for a Capital One loan?

You can apply online, in person, or over the phone. You will need to provide information about your income, expenses, and credit history.

How do I set up online banking with Capital One?

You can set up online banking by visiting the Capital One website and creating an account. You will need to provide your account number, Social Security number, and date of birth.

How do I reset my Capital One online banking password?

You can reset your Capital One online banking password by visiting the Capital One website and clicking on the “Forgot Password” link. You will need to provide your account number and email address.

How do I transfer money between my Capital One accounts?

You can transfer money between your Capital One accounts by visiting the Capital One website or by calling the customer service number.

How do I deposit a check into my Capital One account?

You can deposit a check into your Capital One account by visiting a Capital One branch, by mailing the check to Capital One, or by using the Capital One mobile app.

How can I get help with my Capital One account?

You can get help with your Capital One account by calling the customer service number, by chatting with a representative online, or by visiting a Capital One branch.

What is Capital One’s mission statement?

Capital One’s mission statement is to “help our customers succeed financially.”

What are Capital One’s core values?

Capital One’s core values are putting the customer first, being innovative, being entrepreneurial, being accountable, being diverse and inclusive, and many more, which definitely benefit their customers in any way.

Wrapping It Up

Capital One stands out as a distinctly customer-centric bank, offering an array of products and services tailored to meet diverse financial needs. From credit cards to auto loans, savings accounts to business solutions – it’s more than just another banking institution. Its commitment towards technological innovation sets it apart from its peers, making for seamless banking experiences.

There’s no denying Capital One’s influence in revolutionizing the banking sector. Their dedication to customer service combined with innovative features make this bank a formidable choice for anyone seeking comprehensive financial solutions. The information provided has hopefully given you everything there is to know about Capital One – your potential new home for all things finance.